If you want to manage your Milestone Credit Card account, head over to milestonegoldcard.com and log in to handle your card and finances with ease.

The MyMilestoneCard, provided by the Bank of Missouri and Genesis Financial Solutions, is a credit card tailored for simplicity and financial progress. It’s perfect for individuals with average credit, helping them improve their credit scores while offering special perks. With its user-friendly online platform, managing your finances becomes both easy and beneficial.

What is the Milestone Credit Card?

The Milestone Credit Card is an unsecured MasterCard designed for people with moderate or less-than-perfect credit. It’s widely accepted globally and helps users establish or rebuild their credit history. With no security deposit required, it’s a convenient option for those looking to take control of their financial future.

Key Features at a Glance

Here’s what makes the Milestone Credit Card stand out:

- Credit Building: Reports to all three major credit bureaus (Experian, Equifax, and TransUnion) to help improve your credit score.

- No Security Deposit: Unlike some cards, you don’t need to pay a deposit to get started.

- Customizable Credit Limit: Initial limits range from 300to300to750, with potential increases over time.

- Fraud Protection: Keeps your transactions secure.

- Free FICO Score Access: Track your credit score progress easily.

- Global Acceptance: Use it anywhere MasterCard is accepted.

Fees and Charges

Before applying, it’s important to understand the costs:

| Fee Type | Amount |

|---|---|

| Annual Fee | 35−35−99 (varies based on credit history) |

| Monthly Fee | 14.50(firstyear),then14.50(firstyear),then19.25 |

| APR | 24.90%-26.90% (for purchases and cash advances) |

| Foreign Transaction Fee | 1% |

| Late Payment Fee | Up to $41 |

| Overlimit Fee | Up to $41 |

| Returned Payment Fee | Up to $41 |

How to Apply for the Milestone Credit Card

Applying is quick and easy! Here’s what you need:

- Age and Residency: You must be at least 18 years old and a U.S. resident.

- Required Documents: A permanent address, bank account, U.S. ID, and Social Security Number (SSN).

- Application Process: Fill out the online form with your personal and financial details.

- Response Time: You’ll get a quick decision, and if approved, your card will arrive in a few days.

How to Activate Your Milestone Credit Card

Once you receive your card, you’ll need to activate it. Here’s how:

Online Activation

- Visit the Milestone Credit Card activation page.

- Enter your card details and follow the prompts to verify your identity.

- Submit the information to activate your card.

Phone Activation

- Call the activation number: 1-800-305-0330.

- Provide your card number and personal details when prompted.

- Follow the instructions to complete activation.

Mail Activation

- Check the activation instructions included with your card.

- Fill out any required forms and mail them to the provided address.

- Wait for confirmation that your card is activated.

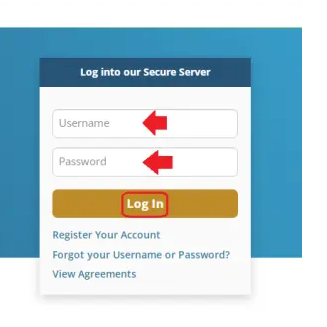

How to Log In to Your Milestone Credit Card Account

Managing your account is simple! Follow these steps:

Visit the Official Website:

- Go to milestonegoldcard.com.

Locate the Login Section:

- Click on “Login” or “Account Access.”

Enter Your Credentials:

- Type in your username and password.

Click ‘Login’:

- Access your account to view balances, make payments, and more.

Forgot Your Username or Password? No Problem!

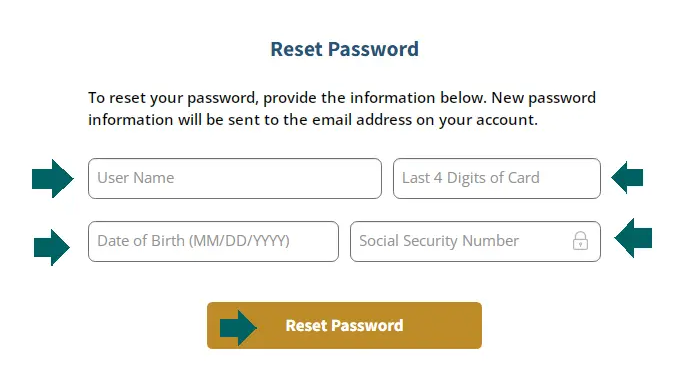

Reset Your Password

- Go to the Milestone Credit Card login page.

- Click “Forgot Password.”

- Enter your username, last 4 digits of your card, date of birth, and SSN.

- Follow the prompts to verify your identity and create a new password.

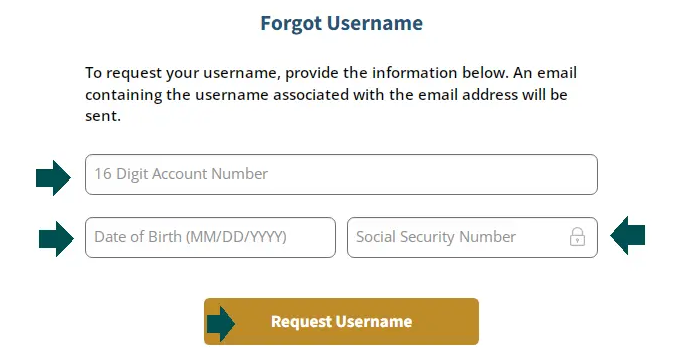

Retrieve Your Username

- Visit the login page and click “Forgot Username.”

- Provide your 16-digit card number, date of birth, and SSN.

- Follow the steps to retrieve your username.

How to Pay Your Milestone Credit Card Bill

Paying your bill is hassle-free with these options:

- Online: Log in to your account and follow the payment instructions.

- By Phone: Call 1-800-305-0330 and pay using the automated system.

- By Mail: Send a check or money order to:

Concora Credit

PO Box 84059

Columbus, GA 31908-4059

Pros and Cons of the Milestone Credit Card

| Pros | Cons |

|---|---|

| Helps build or rebuild credit | Annual and monthly fees apply |

| No security deposit required | High APR compared to some other cards |

| Reports to all three credit bureaus | Limited rewards program |

| Accessible to various credit scores | Lower starting credit limits |

| Fraud protection for secure transactions | Fewer perks and benefits |

Customer Service Contact Information

Need help? Reach out to Milestone Credit Card customer service:

- Phone: 1-800-305-0330

- Fax: 503-268-4711

- Technical Support: 1-800-705-5144

- Mailing Address:

Concora Credit

PO Box 4477

Beaverton, OR 97076-4477

Final Thoughts

The Milestone Credit Card is a solid choice for anyone looking to improve their credit score while enjoying the convenience of a globally accepted MasterCard. While it does come with some fees, its credit-building features and ease of use make it a valuable tool for financial growth. Ready to take the next step? Visit milestonegoldcard.com to apply or manage your account today!

5 Important FAQs About the Milestone Credit Card

How can I check my Milestone Credit Card balance?

Log in to your account at milestonegoldcard.com to view your balance and transaction history.

What is the credit limit for the Milestone Credit Card?

The initial credit limit ranges from 300to300to750, depending on your creditworthiness.

Does the Milestone Credit Card report to credit bureaus?

Yes, it reports to all three major credit bureaus (Experian, Equifax, and TransUnion) to help build your credit score.

How do I activate my Milestone Credit Card?

Activate it online at milestonegoldcard.com or by calling 1-800-305-0330.

What should I do if I forget my login credentials?

Click “Forgot Username” or “Forgot Password” on the login page and follow the steps to recover your details.